Microloans: If you need a smaller loan (ordinarily under $50,000), microloans are an excellent possibility. These loans are sometimes provided by nonprofit companies and so are simpler to qualify for than more substantial loans. These are In particular great for smaller businesses or All those just getting started.

Getting an express reason for taking out a loan isn’t just a wise and dependable Portion of the procedure, Furthermore, it aids lenders make a decision if you and your business are a very good investment. In fact, you’re borrowing their funds—they would like to be sure you have a very good program in mind for That which you’re intending to do with it.

The loan application process will differ by lender, but Below are a few measures to assist you to start the method:

You should use equipment loans to order assets like office and computer equipment, industrial equipment and business autos.

Equipment. When your business demands Particular equipment, new equipment is more expensive upfront but can bolster your base line with decreased Strength charges, less routine maintenance plus more shoppers from the doorway.

You may get an equipment loan as much as the entire value of the equipment you’re looking to buy — based on which equipment finance enterprise you use plus your business’s qualifications.

Irrespective of whether it’s covering fees or getting new machines which can be more energy-successful and value-efficient, a loan will help you continue to be afloat.

We weigh how to get a loan for a restaurant these aspects based on our assessment of which are An important to small-business owners And just how meaningfully they influence borrowers’ activities.

Critiques have not been reviewed, accredited or if not endorsed through the bank card, financing and service firms and It isn't their duty to be sure all posts and/or queries are answered.

Several or every one of the items featured here are from our partners who compensate us. This may impact which merchandise we write about and wherever And the way the item seems on the page. Nevertheless, this doesn't affect our evaluations. Our opinions are our have.

Commence your search by Googling "laundromats on the market around me." This provides up a list of business or broker Internet sites with this type of business for sale close to you.

These eventualities happen usually—significantly for laundromat house owners who frequently find themselves restoring heavily used equipment. Make sure you only borrow around you are aware of you are able to pay for to pay again every month. Most lenders will Assess your ability to pay out in advance of approving your loan, nevertheless it’s very best to suitable-dimensions your expectations just before filling out an software.

Today's property finance loan rates30 12 months mortgage rates5-12 months ARM rates3-year ARM ratesFHA property finance loan ratesVA home loan ratesBest mortgage lenders

SBA loans have attractive interest charges and terms, and are well worth Discovering When your business qualifies.

Tia Carrere Then & Now!

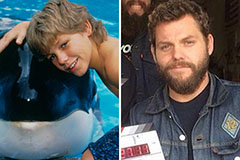

Tia Carrere Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!